After a severe storm, your neighborhood might be buzzing with the sound of hammers. You suspect your roof has damage, but the idea of battling your insurance company sounds like a nightmare.

Will they raise your premiums? Will they deny the claim because the roof is old? What if they only offer $500 for a $10,000 job?

Understanding how the insurance game works is the only way to ensure you get the payout you deserve. This guide demystifies the process and explains the jargon adjusters use to confuse homeowners.

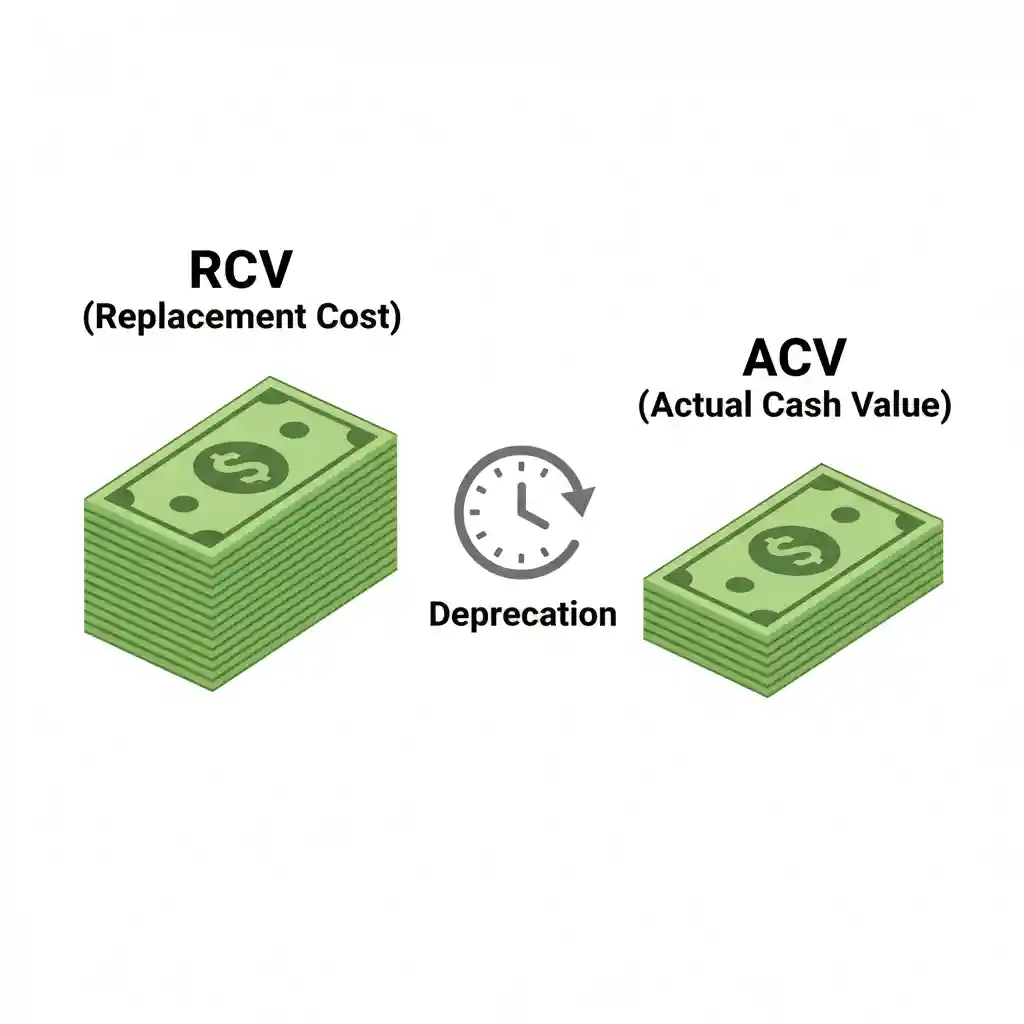

1. Know Your Policy: ACV vs. RCV

This is the single most important concept in roofing insurance. Your payout depends entirely on which type of policy you have.

RCV (Replacement Cost Value)

-

What it is: The insurance company pays what it costs to replace your roof today, regardless of how old your roof is.

-

How it works: They usually write two checks. The first is the “Actual Cash Value.” The second (Recoverable Depreciation) is sent after you prove the work is done.

-

Verdict: This is the best coverage to have.

ACV (Actual Cash Value)

-

What it is: The insurance company pays for the replacement cost minus depreciation.

-

How it works: If your roof is 15 years old, they might say it has lost 75% of its value. If a new roof costs $10,000, they might only write you a check for $2,500 (minus your deductible).

-

Verdict: You will likely have to pay thousands out of pocket.

2. What Counts as “Damage”? (Wind vs. Hail)

Insurance covers “sudden and accidental” damage. It does not cover “wear and tear.” Knowing the difference is key to getting approved.

| Damage Type | What Adjusters Look For | Is It Covered? |

| Hail Damage | “Bruises” or dark spots where granules have been knocked off the shingle. Dents on gutters and vents. | YES (Usually) |

| Wind Damage | Creased shingles (a sharp line near the top), torn shingles, or missing sections. | YES |

| Fallen Tree | Structural damage to decking or rafters caused by impact. | YES |

| Old Age / Blistering | Shingles losing granules due to sun exposure or poor ventilation. | NO (Wear & Tear) |

| Moss / Algae | Green or black streaks on the roof. | NO (Maintenance Issue) |

3. The 6 Steps to Filing a Successful Claim

Don’t call your insurance agent immediately. Follow this order of operations to protect your claim.

Step 1: Verify the Date of Loss

You must know exactly when the damage happened. Insurance companies track storms. If you say “it happened last week” but storm records show clear skies, your claim will be denied.

Step 2: Get a Professional Inspection First

Before filing, have a reputable roofer inspect the roof.

-

Why? If you file a claim and the adjuster finds no damage, that “claim” still goes on your record as a zero-payout incident, which can hurt your rates.

-

A pro will tell you if there is enough damage to warrant a claim.

Step 3: File the Claim

Call your insurance carrier’s claims department. Give them the date of loss and the type of damage (Wind/Hail). They will assign an Adjuster.

Step 4: The Adjuster Meeting (Crucial!)

The insurance adjuster works for the insurance company, not you. Ask your roofer to be present at this meeting.

-

A good roofer will walk the roof with the adjuster and point out damage the adjuster might “miss” (or ignore). This significantly increases approval rates.

Step 5: The “Scope of Loss”

You will receive a document detailing what the insurance agrees to pay for. Compare this with your roofer’s estimate. If the insurance estimate is too low (e.g., they missed the cost of permits or ice & water shield), your roofer can file a Supplement.

Step 6: Construction & Final Payment

Once the work is done, your roofer sends a Certificate of Completion to the insurance company to release the final depreciation check.

4. Common Myths About Insurance Claims

Myth: “If I file a claim, my rates will go up.”

Fact: Insurance rates typically go up based on zip code risk (e.g., a massive hurricane hitting the whole city), not individual claims for “Acts of God.” However, negligence claims can raise rates.

Myth: “I should get 3 estimates and keep the extra money.”

Fact: With an RCV policy, you cannot profit from the claim. If you find a roofer who does it cheaper than the insurance estimate, the insurance company simply lowers their final payout. It is insurance fraud to manipulate the numbers to keep cash.

Myth: “My roofer offered to pay my deductible.”

Fact: This is illegal in many states. If a roofer says “we will eat your deductible,” run away. It usually means they are cutting corners on materials to make up the cost, or they are asking you to commit insurance fraud.

Final Thoughts: Who Do You Trust?

The insurance process is adversarial by nature. The insurance company wants to minimize the payout; you want a quality roof.

The most important decision you make is not which insurance company you choose, but which Roofing Contractor you hire to advocate for you. A contractor experienced in insurance restoration knows the software (Xactimate) adjusters use and can ensure every necessary component—from the drip edge to the ridge vent—is included in your claim.

Always read your policy’s fine print, and remember: You have the right to choose your own contractor. You are not required to use the insurance company’s “preferred vendor.”